What Entity is Right for my Company?

Unlike standard C corporations, both S Corporations (“S Corps”)—corporations taxed under Subchapter S of the Internal Revenue Code—and limited liability companies (“LLCs”) are treated as pass-through entities for taxation purposes, which may lead to significant tax savings over the course of a business’s life.

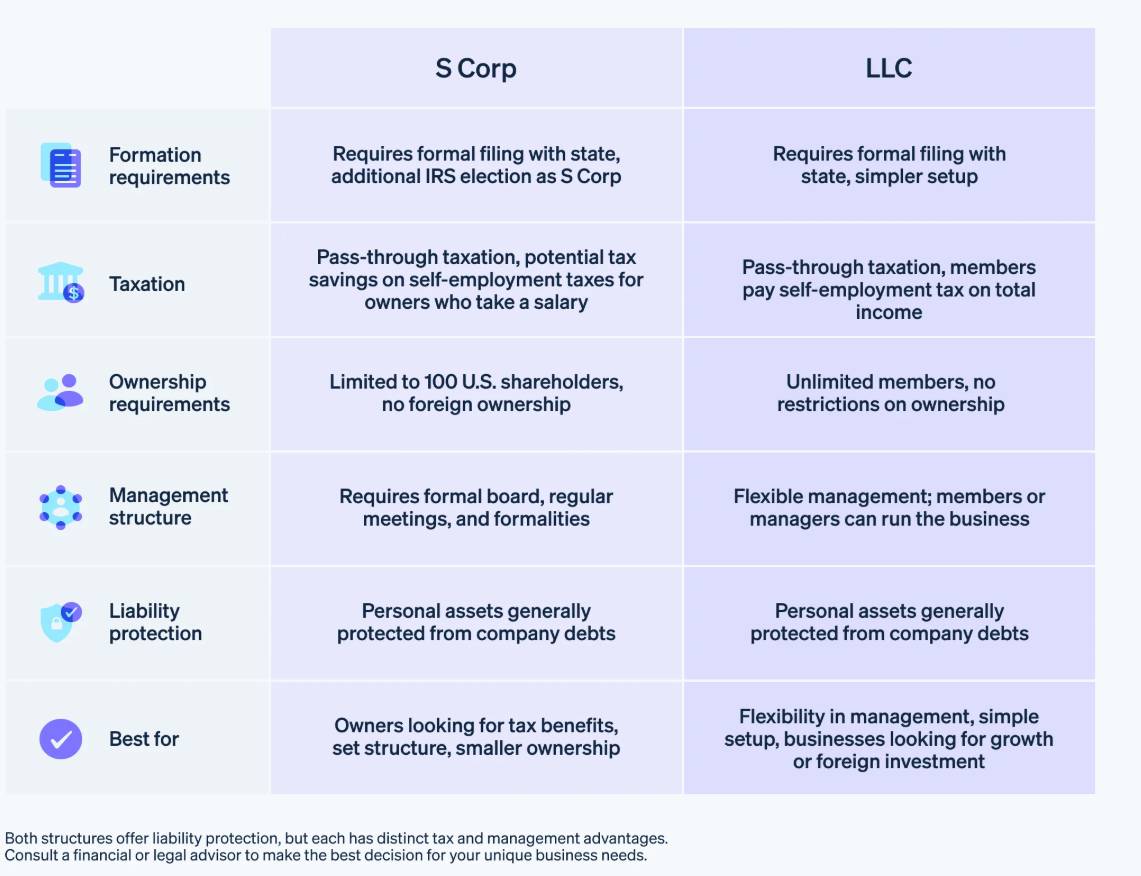

Understanding the differences between an S Corp and an LLC is critical to ensuring you select the best structure for your company.

Tax Treatment and Structure

The most obvious difference between an S Corp and an LLC is the way the entity is treated for tax purposes. LLCs are treated as pass-through entities, which means that the income of the LLC flows through to its members’ individual tax returns, so the income is only taxed once. On the other hand, S Corps are accounting entities, meaning the S Corp itself calculates income and deductions at the corporate level before income is allocated to individual shareholders. That income then similarly passes-through to the individual shareholders’ tax returns.

S Corporation Potential Tax Advantage

S Corps may offer tax benefits to businesses that earn excess profits. S Corps must pay their employees “reasonable” salaries (comparable to others in the same industry); however, all excess profits can be distributed to shareholders as dividends, which are typically taxed at a rate lower than ordinary income is taxed.

LLCs Are Popular in Texas

In the State of Texas, over 89% of new entities are formed as limited liability companies.

LLCs are the most popular entity type because they:

- are easy to create and use

- are flexible (many governance & taxation options)

- protect the LLC’s owners from personal liability

- insulate the LLC’s assets from the LLC’s owners’ creditors

- profits and losses can be passed through without facing corporate taxes

Summary Chart

Get Business Formation Guidance

The differences between S Corps and LLCs can be complex, and this article only highlights some of the key distinctions between them. The proper organization of your company is a critical decision that will impact its future success.

Please contact McGarvey PLLC for further information on this topic.

Read More

Common Scams Befalling the Elderly and How to Avoid Them!

Learn common scams targeting seniors, including government, tech support, romance, and property fraud, with clear tips to recognize and avoid them.

When Estate Administration is Necessary (and how to avoid it)

Learn when estate administration is required in Texas, what probate involves, and the legal options available to transfer assets without probate.

The Protections of a Power of Attorney (POA) to Avoid Guardianship

A Power of Attorney can prevent the need for guardianship, protecting your rights and easing the burden on loved ones through smart, early planning.